Trends | Is Mobile Banking Here to Stay? A 15-Month Deep Dive

Mobile banking has taken over financial industry in the last several years. The pandemic indirectly led to less physical transactions while incentivizing digital options – and options came. GCASH and PAYMAYA exploded into the scene and provided most Filipinos an alternative to cash based payments. By the end of 2020, GCASH hits 1-Trillion worth of transactions.

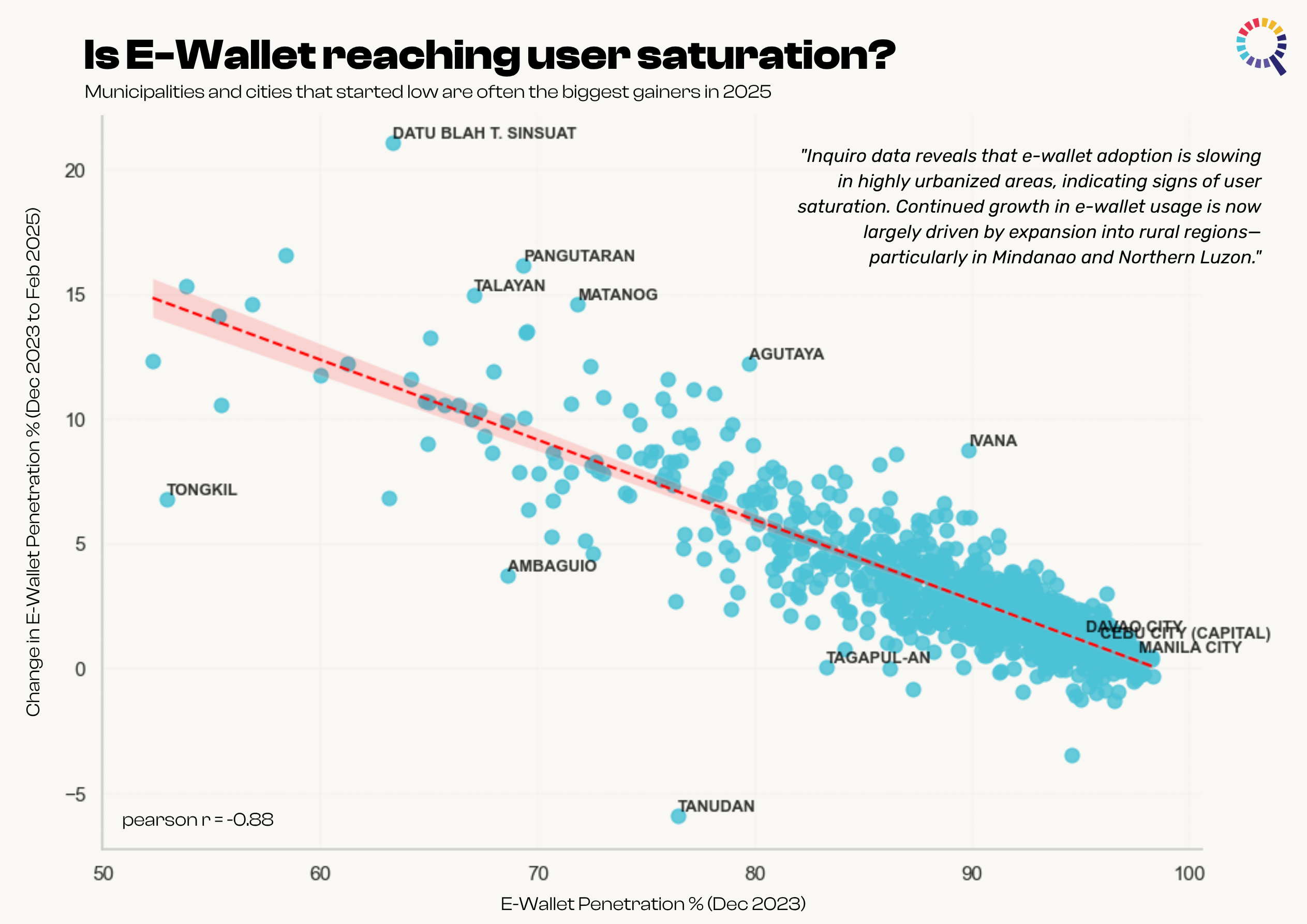

The growth of e-wallets is directly attributed to the necessity of the time, but as we ease back to ‘normal’, is e-wallet here to stay?

We are going to use market scan to get a sample of Philippine population and trace mobile banking trends historically. Let’s consider a 15-month period between December 2023 to February 2025. Subscribing to the product in an extended period of time allows us to track these changes.

Region

Based on this initial analysis, mobile banking user growth is driven by Mindanao and Northern Luzon. These market have yet to be fully penetrated by e-wallets and are prime opportunities for expansion. Between December 2023 to February 2025, NCR saw a 0.5% bump while BARMM achieved a 8.2% jump within the same period.

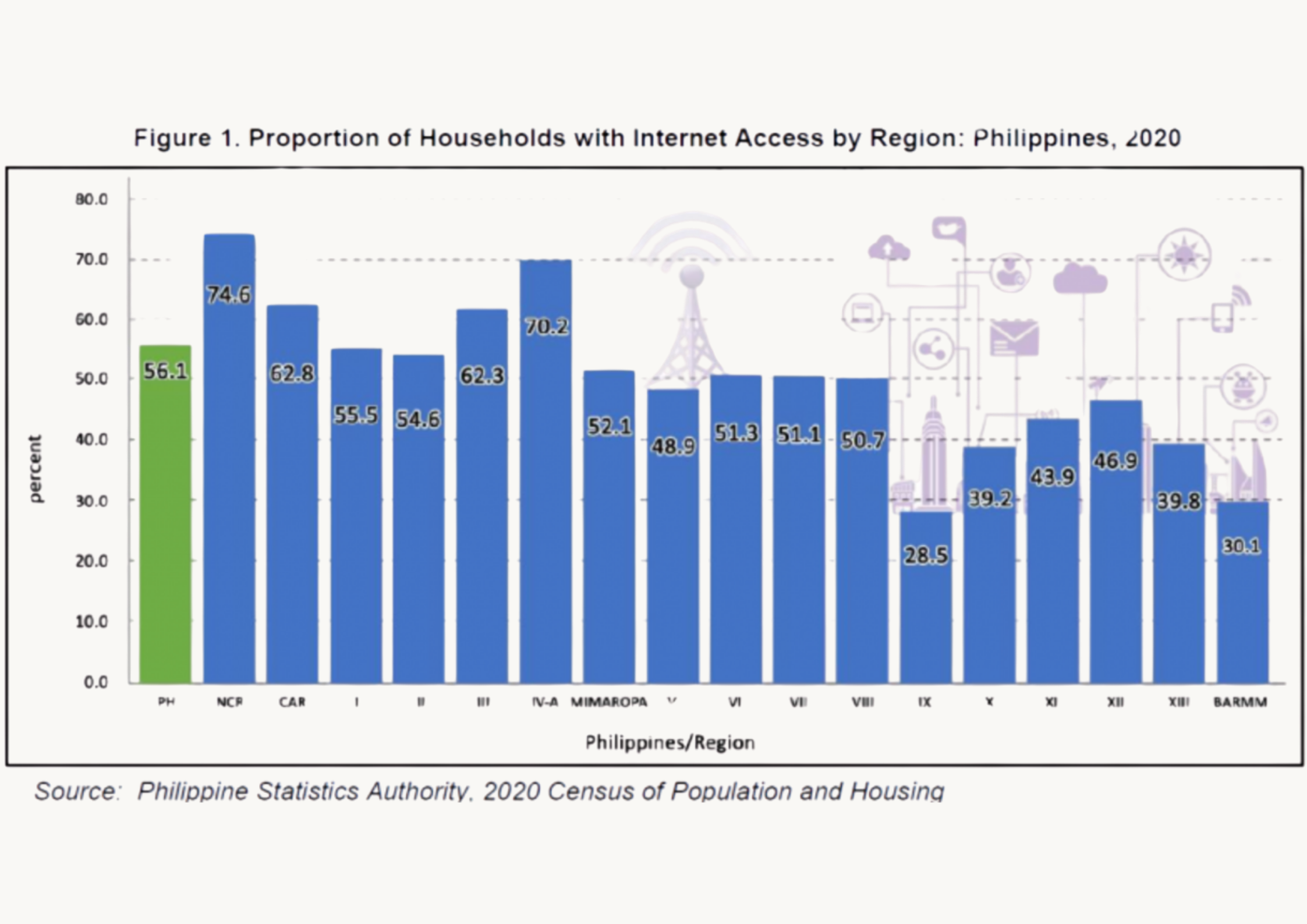

Areas in Mindanao and Northern Luzon are catching up quick. We can look at several factors on why they started low in the first place. The most probable reason is simply: less access to internet.

In 2020, all Mindanao regions saw relatively lower proportions of household with access to internet as compared to Luzon and Visayas. This is due to the persistent underfunding of Mindanao development, high poverty rate, and lower population density.

Bridging the gap

The bottom regions in mobile wallet penetration consistently records the highest increase from 2023 to present. Using acquisition tools, we can target these users, do an ad campaign through their preferred messaging and social media channels. This presents a great opportunity for mobile banks looking to expand their base.

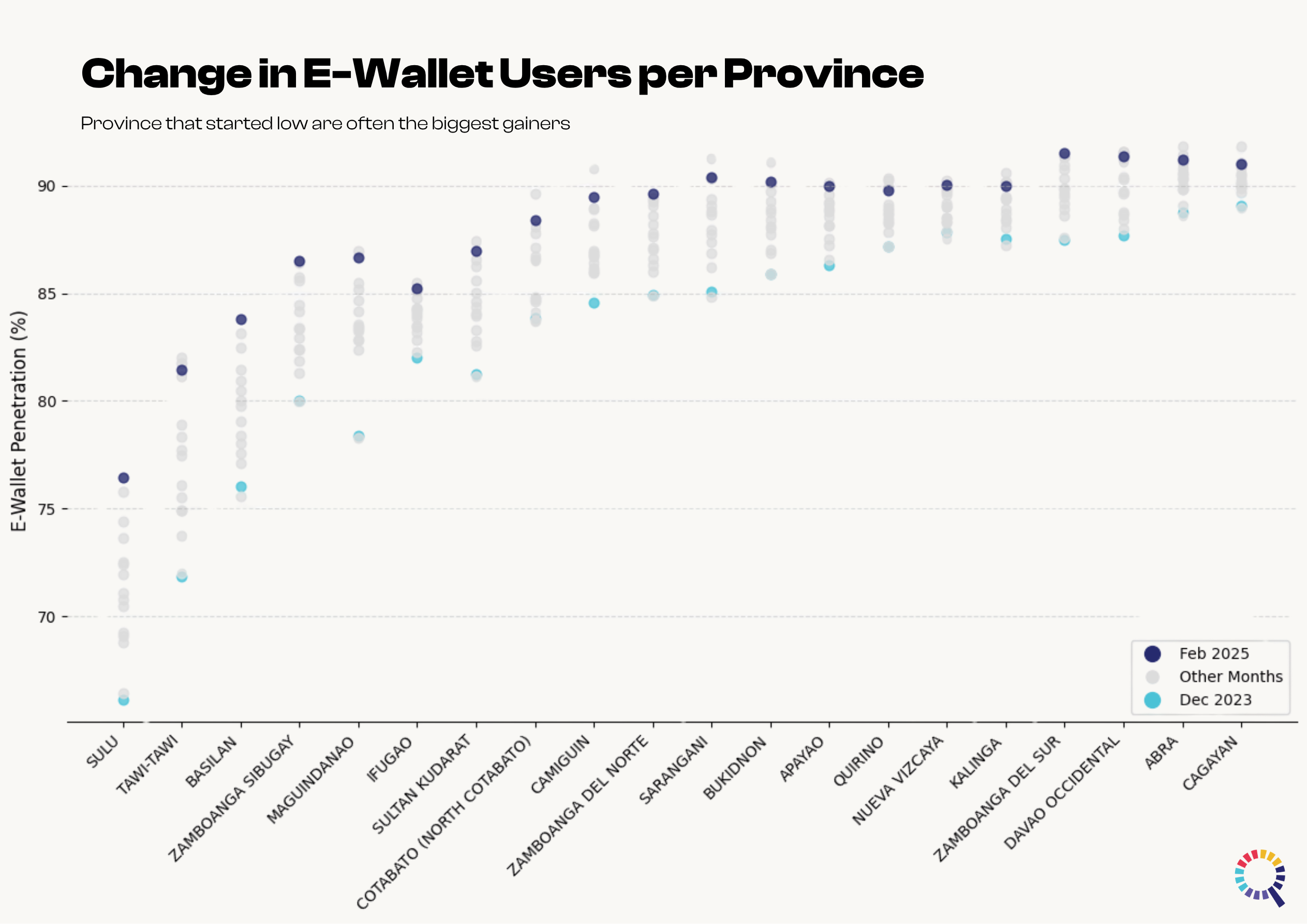

Province

Further investigation on provincial level, we can see 13 out of the bottom 20 provinces are from Mindanao. Ifugao saw the lowest average mobile wallet adoption in Luzon.

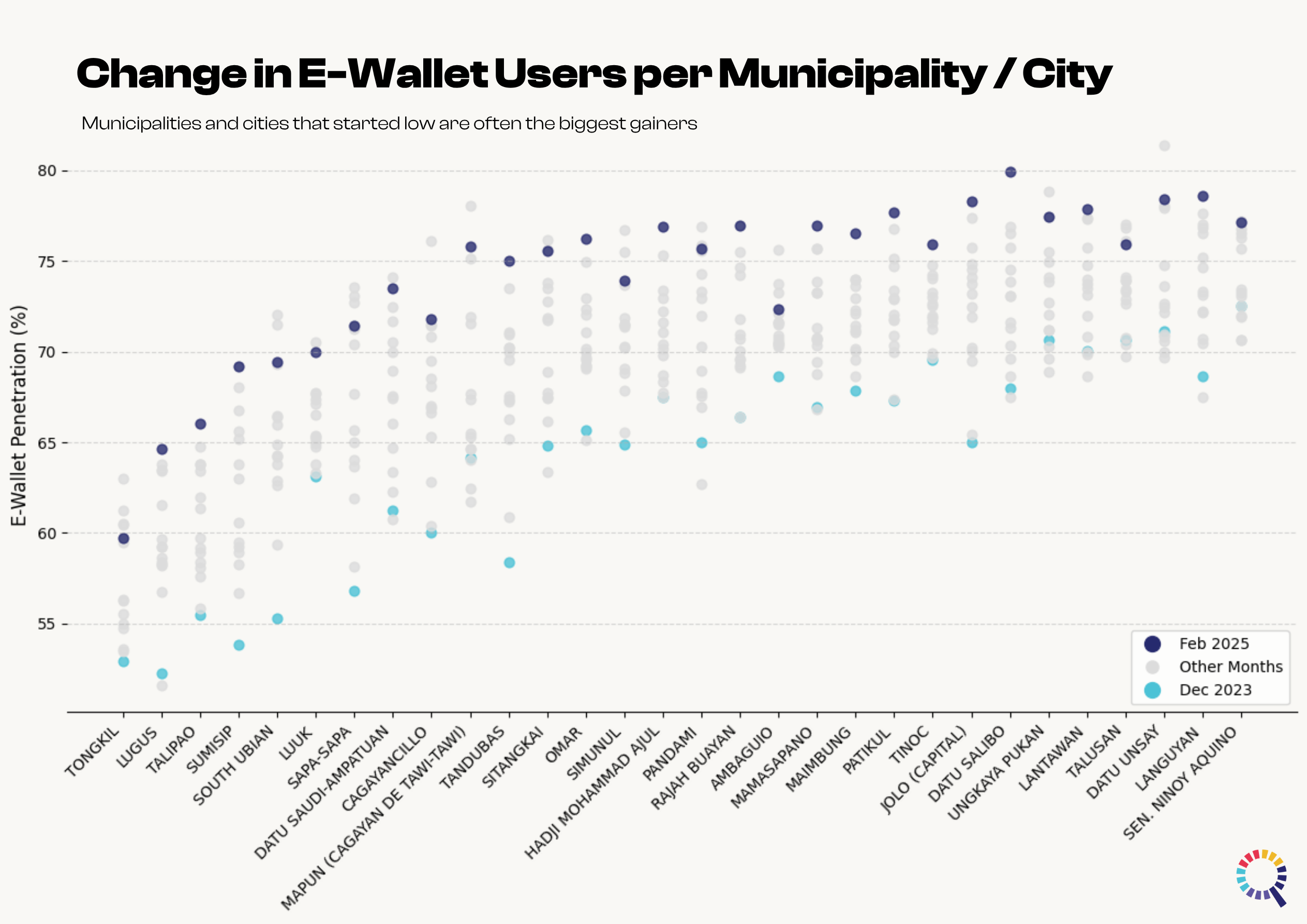

Cities

Highly urbanized areas in Mindanao such as Davao City is a strong outlier, with a survey showing 9 out of 10 respondents use mobile wallets in digital transactions. The study from University of Mindanao affirms that convenience and speed are the benefits that they associate with cashless transactions. Meanwhile technical issues or outages is the main disadvantage.

Takeaway

Davao and other highly urbanized cities are starting to saturate with users, with most of them hitting the lowest growth in terms of penetration. In contrasts, cities that started low in December of 2023 are the highest gainers in our sample, with a correlation of -0.88. Most of them are in rural areas in Mindanao, and Northern Luzon.

Summary

Government and private institutions have made significant strides in bridging the e-wallet adoption gap in rural areas, demonstrating a strong commitment to digitalization. These efforts, through partnerships, innovative programs, and access to technology, have made a tangible impact on financial inclusion.

In December 2023, 450 cities in our sample had less than 90% e-wallet usage. Thanks to continuous investment and targeted initiatives, including government-led financial literacy campaigns, partnerships with fintech companies, and increased internet connectivity, this number has now decreased to just 251 cities by February 2025. The progress is clear: more cities are embracing digital payment solutions, making financial services accessible to millions of underserved citizens.

“The rapid growth of e-wallets has significantly changed financial transactions, allowing electronic transfers, payments, and savings management via smartphones. By end of fiscal year 2025, registered e-wallet accounts are projected to exceed 95 million, a substantial increase within five years. This growth is due to successful digital transformation, widespread mobile technology adoption, supportive regulations, and government investments. Additionally, the Philippines has a large, tech-savvy young population and a high internet penetration rate, leading to increased use of online platforms” – Senthil Kumar (Inquiro CEO)

Mobile banking is here to stay, and there is still so much more room to grow.

Through Inquiro products, we can analyze your base, acquire new customers, and know exactly what they need. Interested in our solutions? Contact us at info@inquiro.ph.