Trends | Insurance in the Philippines

Insurance adoption has been slow in the Philippines. As of 2025, the Philippine population stands at roughly 116.6 million and is projected to inch up to 116.79 million by mid-year. Yet despite steady growth and widespread enrollment in PhilHealth—covering about 83% of the population—only 28% of Filipinos hold life insurance, according to the Insurance Commission. Overall insurance penetration remains low at just 1.7% of the country’s GDP, highlighting a significant protection gap. Experts point to cultural beliefs, financial constraints, low awareness, and affordability as key reasons why life insurance adoption remains sluggish, even as its role in national development becomes increasingly important.

But who’s actually buying in?

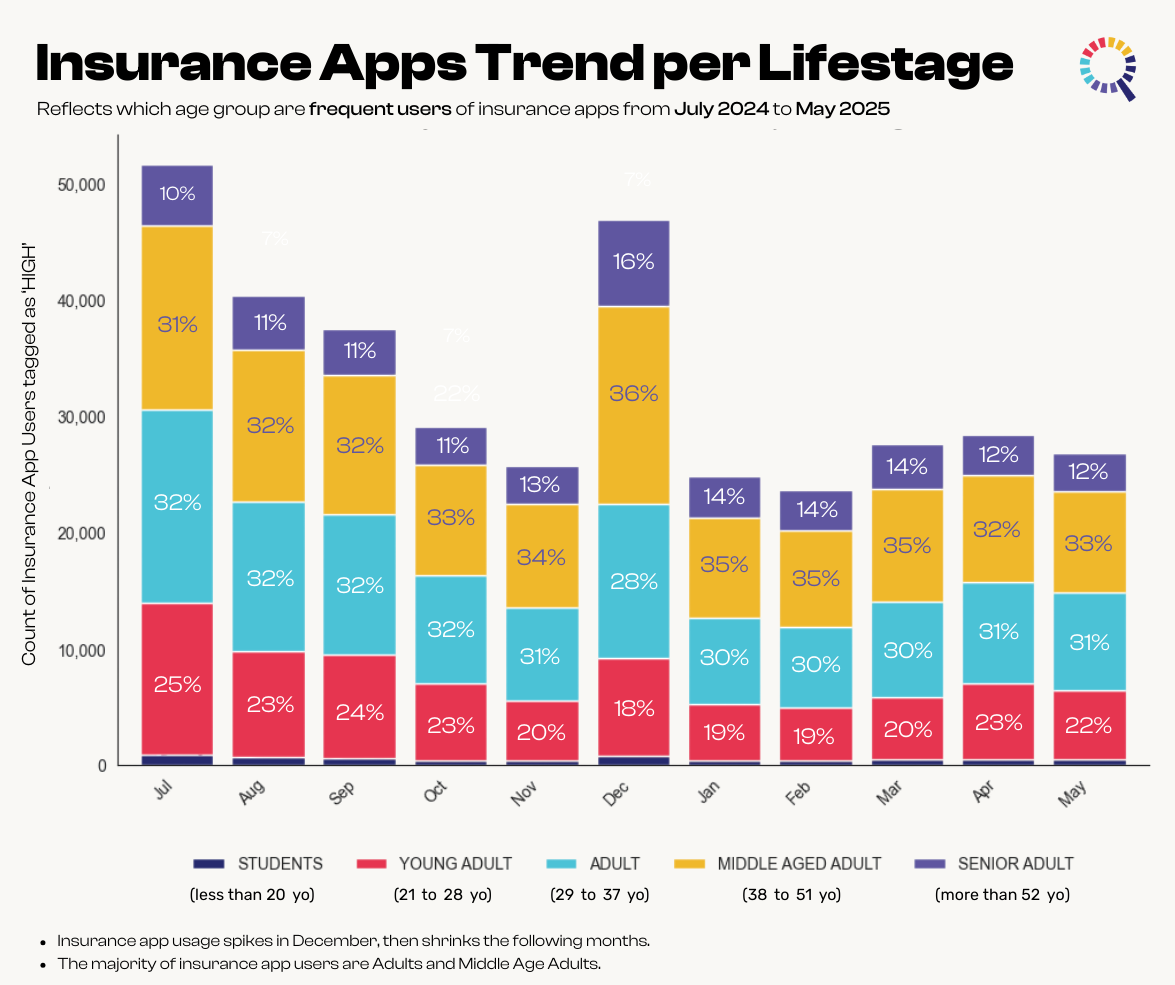

To better understand the slow uptake, it helps to look at who’s engaging with insurance apps in the first place. Usage patterns between July 2024 and May 2025 reveal that adoption skews toward older age groups—those likely balancing family responsibilities and financial planning. While younger Filipinos are digital natives, it’s the more financially mature segments who are leading in app-based insurance activity.

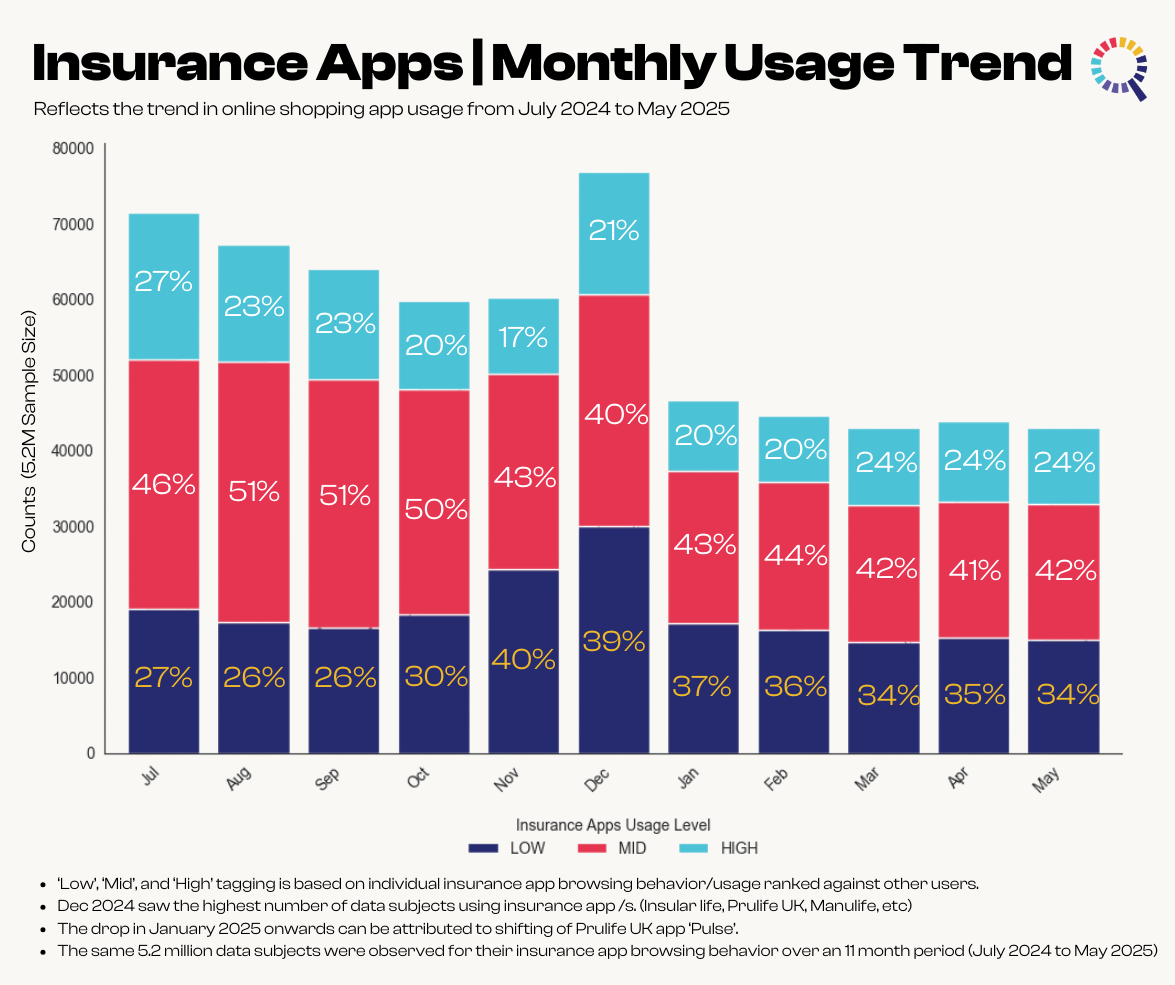

We will use a sample from Inquiro’s MarketScan dataset to view the current trends in insurance app usage, which age groups are using the most, and which apps are popular and trending. For this study, we have 5.2M users, spread across the Philippines as our sample size.

Demographic View

A Mature User Base

Looking at the frequent users of insurance apps, clear demographic profile emerges. The digital shift is not being led by the youngest generation, but by established, financially mature individuals. Adults (29-37 yo) and Middle-Aged Adults (38-51 yo) consistently constitute the overwhelming majority of frequent users.

Middle-Aged Adults Drive the Peak

During the critical December spike, Middle-Aged Adults become the single most dominant user segment, accounting for over a third (36%) of all high-frequency users. This indicates that this demographic, with its greater financial responsibilities and assets, is the primary audience for digital insurance services today. While younger users like students do show increased interest during this period, the core market remains firmly in the 29-51 age bracket.

The December Rush

A bird’s-eye view of monthly insurance app usage reveals a distinct and powerful trend: a massive surge in user activity every December. During this month, the number of users engaging with insurance apps climbs dramatically, driven by a significant increase in both moderately and highly frequent users.

This end-of-year peak suggests that Filipinos are using this time for annual financial check-ups, policy reviews, and new plan acquisitions. Following this intense period, engagement sees a sharp drop in January and stabilizes in the following months. For insurers, this pattern highlights December as the most critical period for acquisition, customer support, and retention efforts.

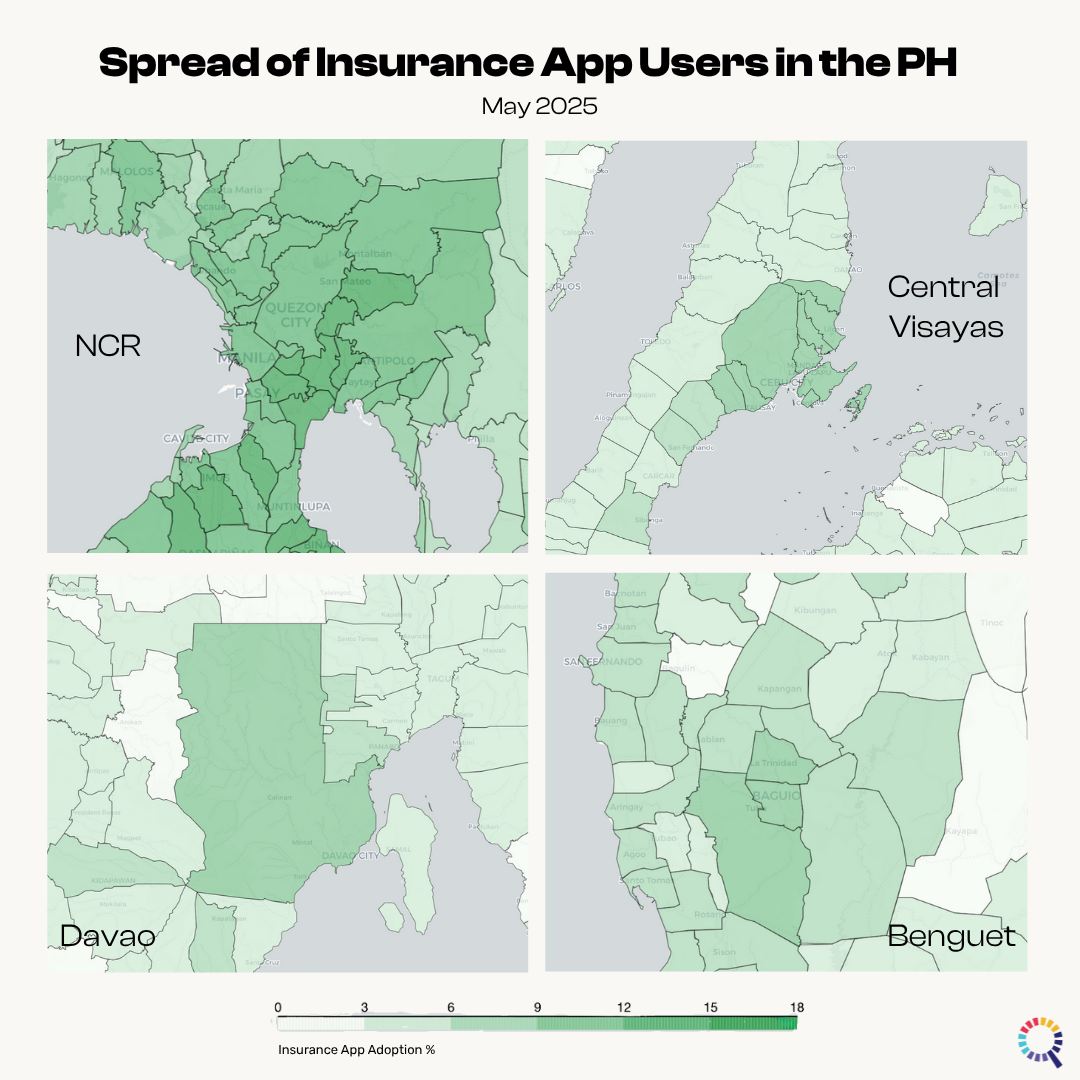

The Regional Picture: Modest Growth, Uneven Spread

Despite the uptick in December, average insurance adoption in the Philippines has been slow.

Urban areas continue to dominate in terms of adoption percentages. In places like Metro Manila (NCR), Cebu (Central Visayas), Davao City, and Baguio/Benguet, insurance apps have carved a noticeable digital footprint. These cities benefit from higher smartphone penetration, faster internet speeds, and stronger financial literacy, all contributing to the higher engagement with insurance platforms.

Zooming In: Four Key Regions

Visualizations highlight adoption percentages as of May 2025, with darker greens indicating higher app usage:

-

Metro Manila (NCR): The epicenter of insurance app activity. Highly urbanized, densely populated, and digitally connected, NCR continues to set the pace in terms of app usage.

-

Central Visayas: A standout in the Visayas, especially around Cebu, which mirrors NCR’s trends on a smaller scale. Island provinces show weaker engagement, hinting at potential digital and infrastructural gaps.

-

Davao Region: Davao City leads in Mindanao, though neighboring provinces still lag behind. There’s an opportunity here for insurers to expand outreach and accessibility.

-

Benguet and Cordillera: A relatively strong performer in northern Luzon. Baguio and surrounding areas show encouraging signs of app-based financial engagement despite being geographically remote.

Rural Gaps and Opportunities

Many rural municipalities across the country remain lightly shaded or pale in our maps — indicating low or negligible adoption. In some areas, this may reflect limited access to mobile infrastructure, but in others, it suggests an untapped demographic of digitally capable users who have yet to be reached.

Some municipalities even recorded zero app usage as of May 2025, particularly in parts of Tawi-Tawi, Northern Samar, and remote Mindanao regions. For insurers, these represent both a digital divide and a business opportunity.

Conclusion: The Path Forward

The trends are clear: the future of insurance in the Philippines is driven by digital adoption and financial stability of users – especially in key regions. For insurance companies, success will depend on their ability to spread awareness on the importance of insurance coverage, which kind of insurance to avail, and how seamless it connects to digital platforms. A successful campaign should focus on year-end period, where people usually have extra money to spend, on age group that has demand for it (adult to middle age adult), and to places with financially literate population.

The challenge and opportunity lie in more affluent individuals to include insurance in their financial considerations while uplifting more Filipinos to more favorable financial situations where insurance can be included in their budget.

All of these charts are powered by Inquiro’s dynamic and holistic database of millions of Filipinos. If you want to learn more about our products, you may contact us info@inquiro.ph.