Pushing Financial Inclusion Through Fintech Innovations

The pandemic brought significant changes to the banking industry and kickstarted the fintech sector in the country. Traditional banking giants like BDO and BPI had dominated the field for many years. In 2021, after months of lockdowns and quarantines, Filipinos chose to transact digitally.

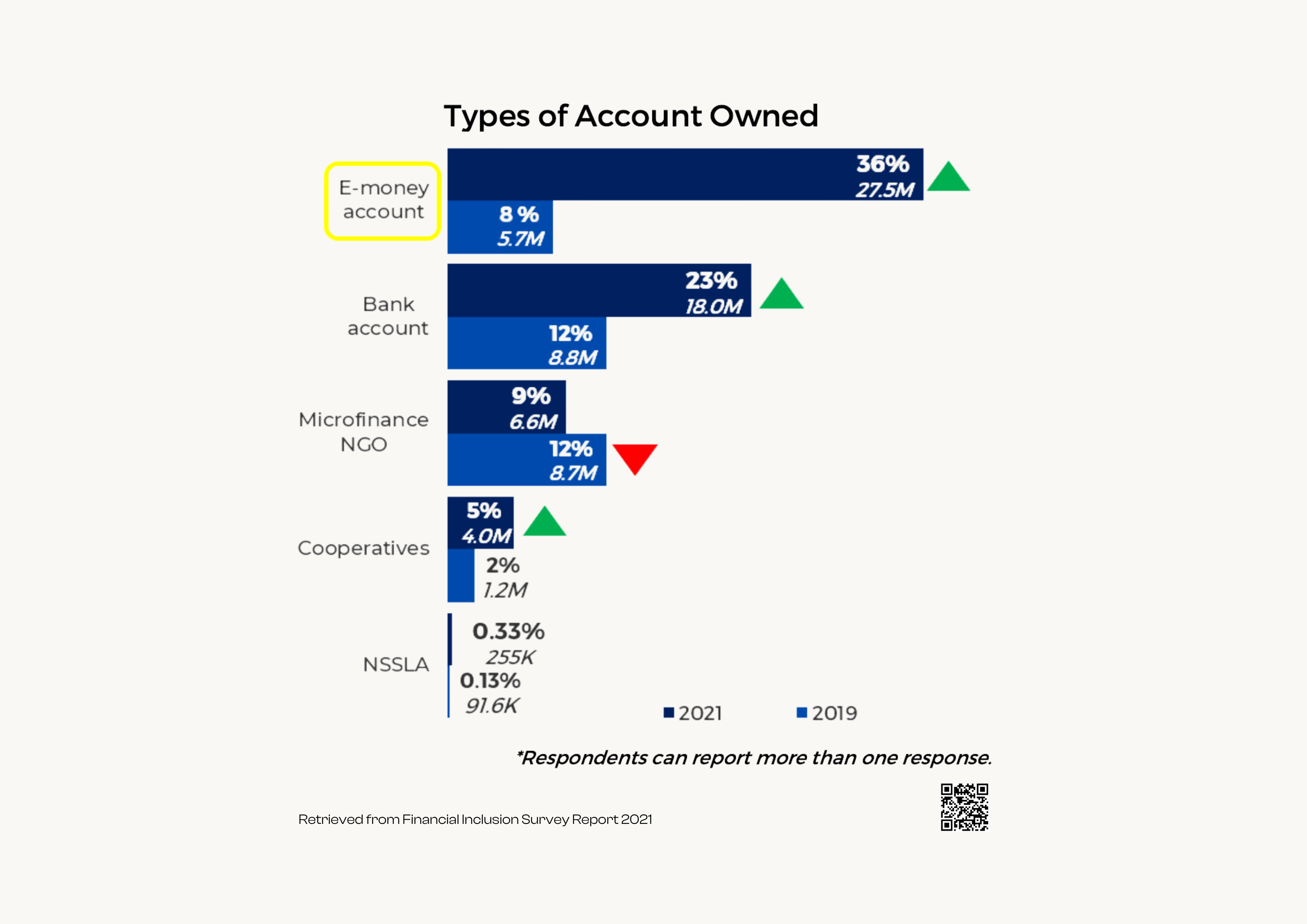

A key moment that year was when e-money accounts surpassed the number of formal bank accounts—an increase in market share from 8% in 2019 to a staggering 36%. Formal bank accounts also doubled from 12% to 23% in the same period, but it became clear that Filipinos preferred e-money accounts for everyday transactions. This shift triggered a race among banks to adapt to the new trend and capture the digital market.

In 2020, only 27 BSP-regulated banks had digital onboarding capabilities. By Q4 2023, that number had risen to 61. Similarly, the share of digital payments across all transactions grew from 24% in 2019 to 55% by Q4 2023. The Fintech industry experienced explosive growth post-pandemic, while traditional banks are still trying to catch up.

Yet, a significant portion of Filipinos remains unbanked, despite 68% having access to mobile phones and the internet. How can we reach them?

Using Inquiro’s holistic and dynamic data of over 90 million Filipinos, let’s try to find out.

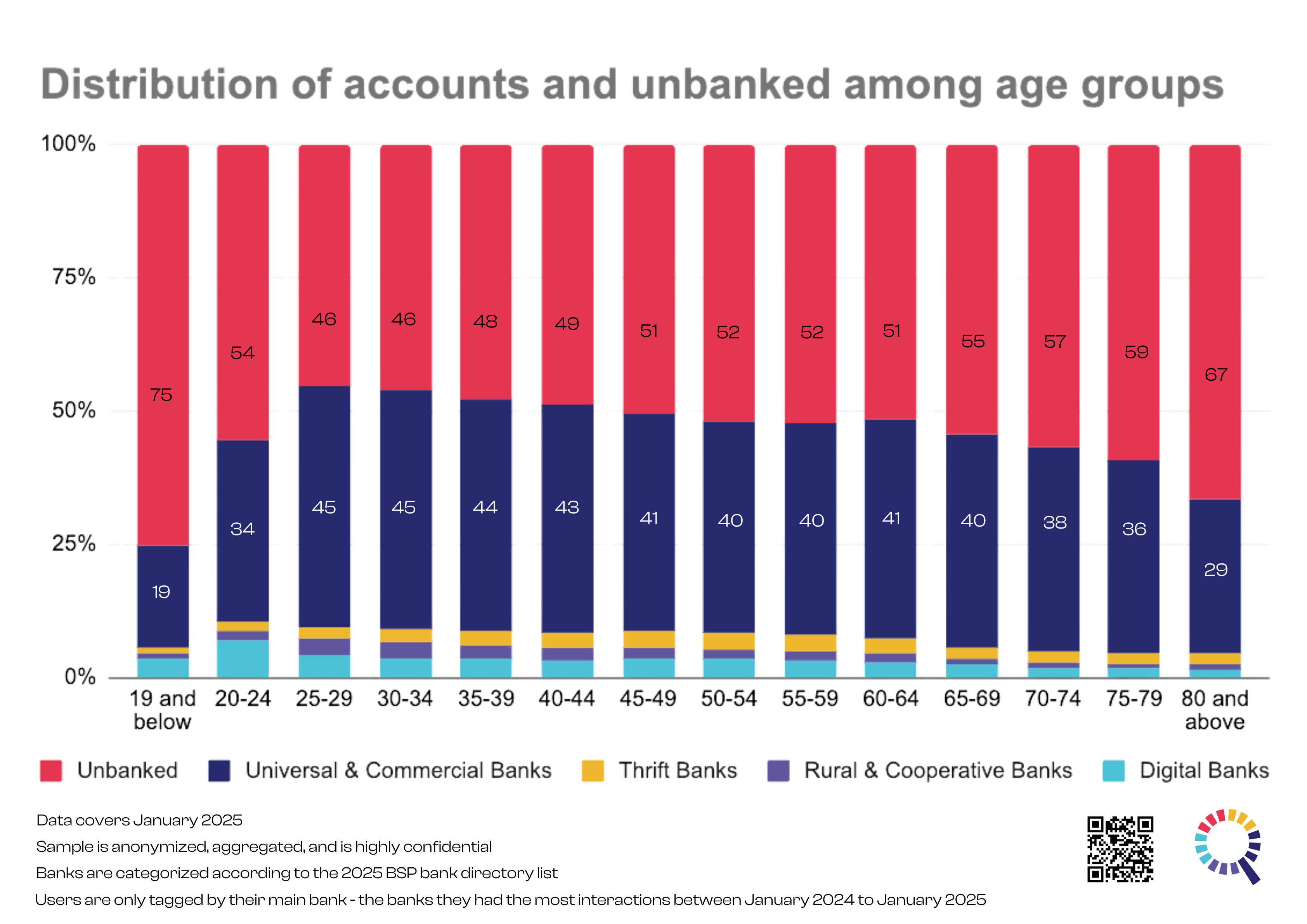

Younger Filipinos are more likely to be unbanked than older generation. Banked individuals peaks at 25-29 which is the start of working population. This is also the age group where Filipinos start building their own families, investing in real state, and developing their formal financial credit.

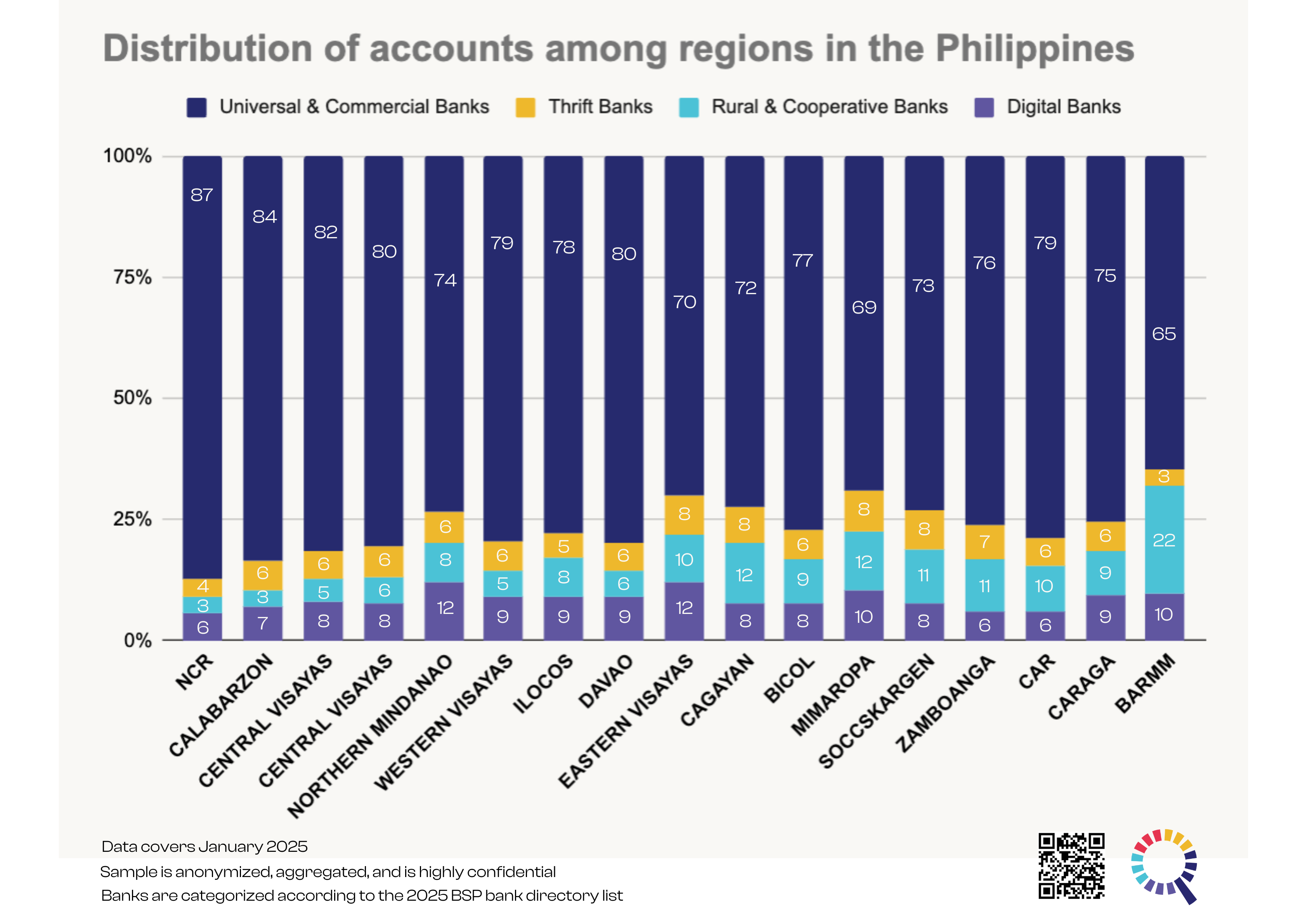

Among those with formal accounts, universal and commercial banks continue to dominate across generations, holding around 80% of the market. Digital banks are starting to tap younger generation—a clear sign that the shift that began in 2021 is here to stay. As this younger generation matures, they will demand better and more seamless banking experiences, pushing traditional banks to adapt.

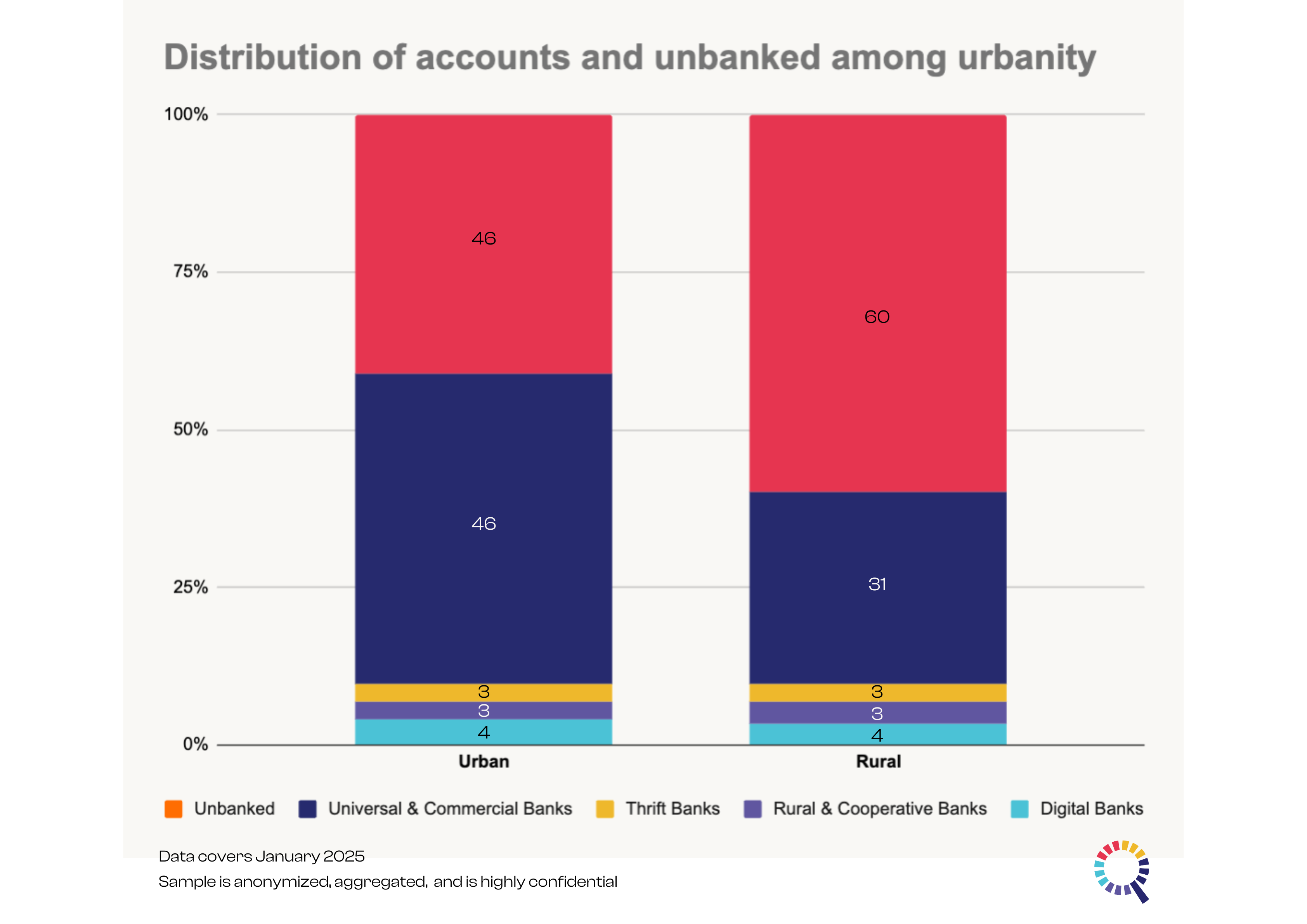

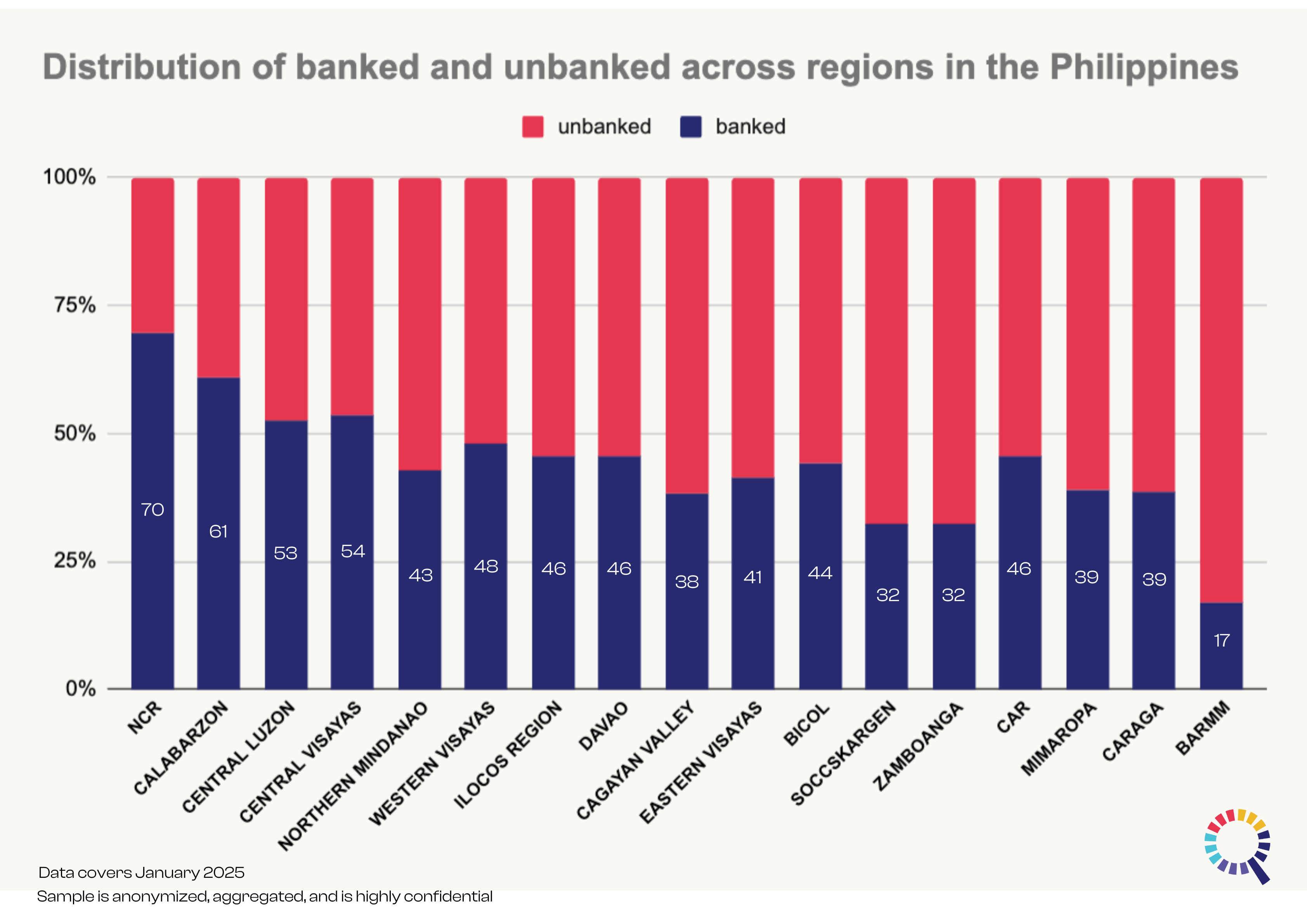

What does Inquiro know about the unbanked? First we know where they are concentrated. Aggregating anonymous profiles by location, we can see that BARMM had the highest concentration of unbanked in the country. Given the recent restructuring of governance in the region, there is a huge opportunity to tap this market once more and more people have access to internet, electricity.

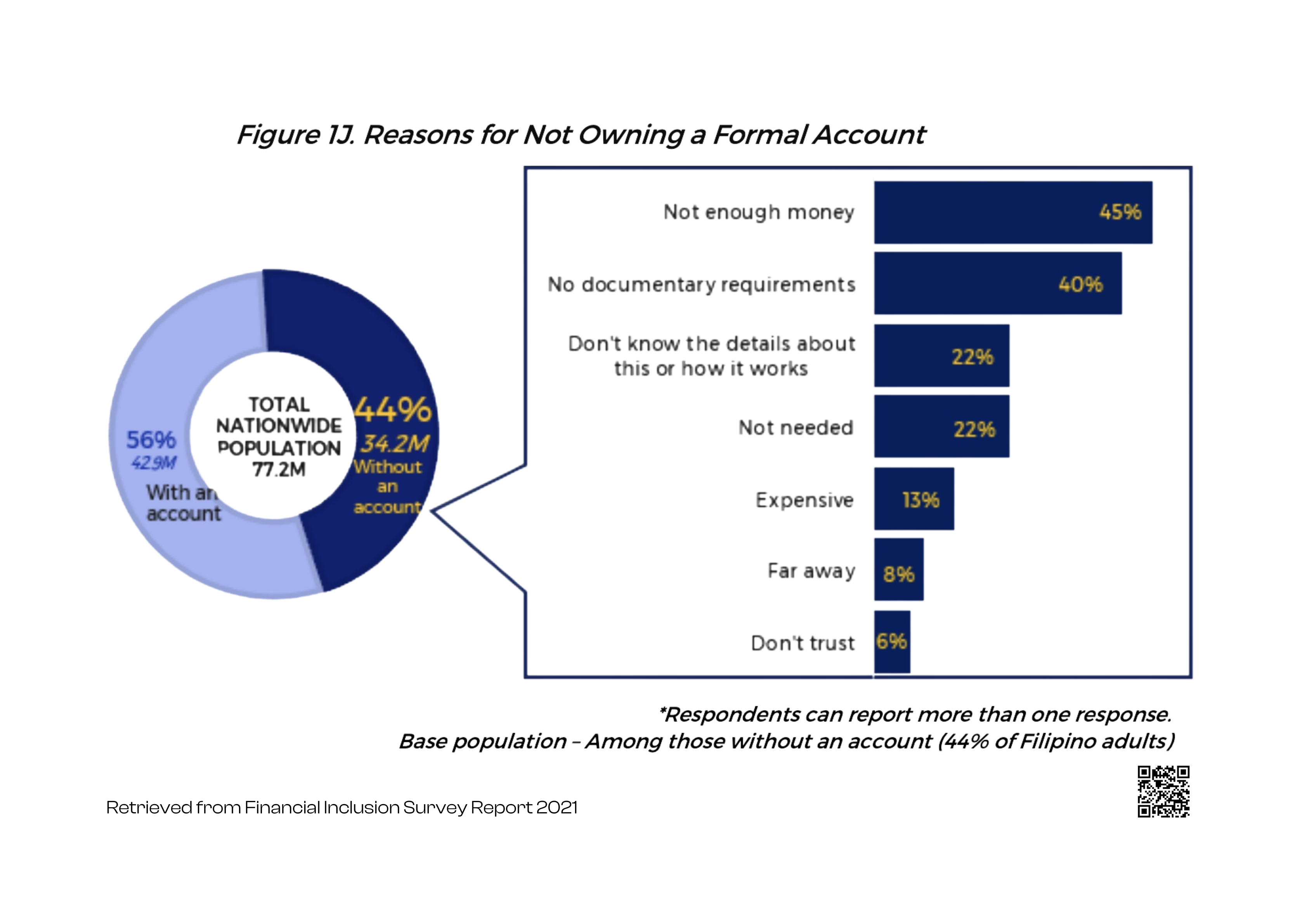

Opening a traditional bank account typically requires more effort compared to signing up for a digital bank via an app. As reported in the Financial Inclusion Survey, 40% of unbanked cited lack of documentary requirement as reason for not opening an account. This was followed by lack of knowledge on the process and perceived lack of need for an account, both at 22%.

This presents a key opportunity to reach the unbanked through digital platforms with far less requirements. Many banks have already taken this route by partnering with mobile wallets and enabling seamless transactions between them. Mobile wallets and digital banks serve as crucial gateways to formal banking. Notably, 87% of unbanked Filipinos owned a mobile phone, of whom, 79% had access to the internet.

“Mobile wallets, digital banks serves as gateway to formal banking”.

In the banked segment, rural and cooperative banks have significant presence in BARMM, capturing 20% of the banking segment in the region.

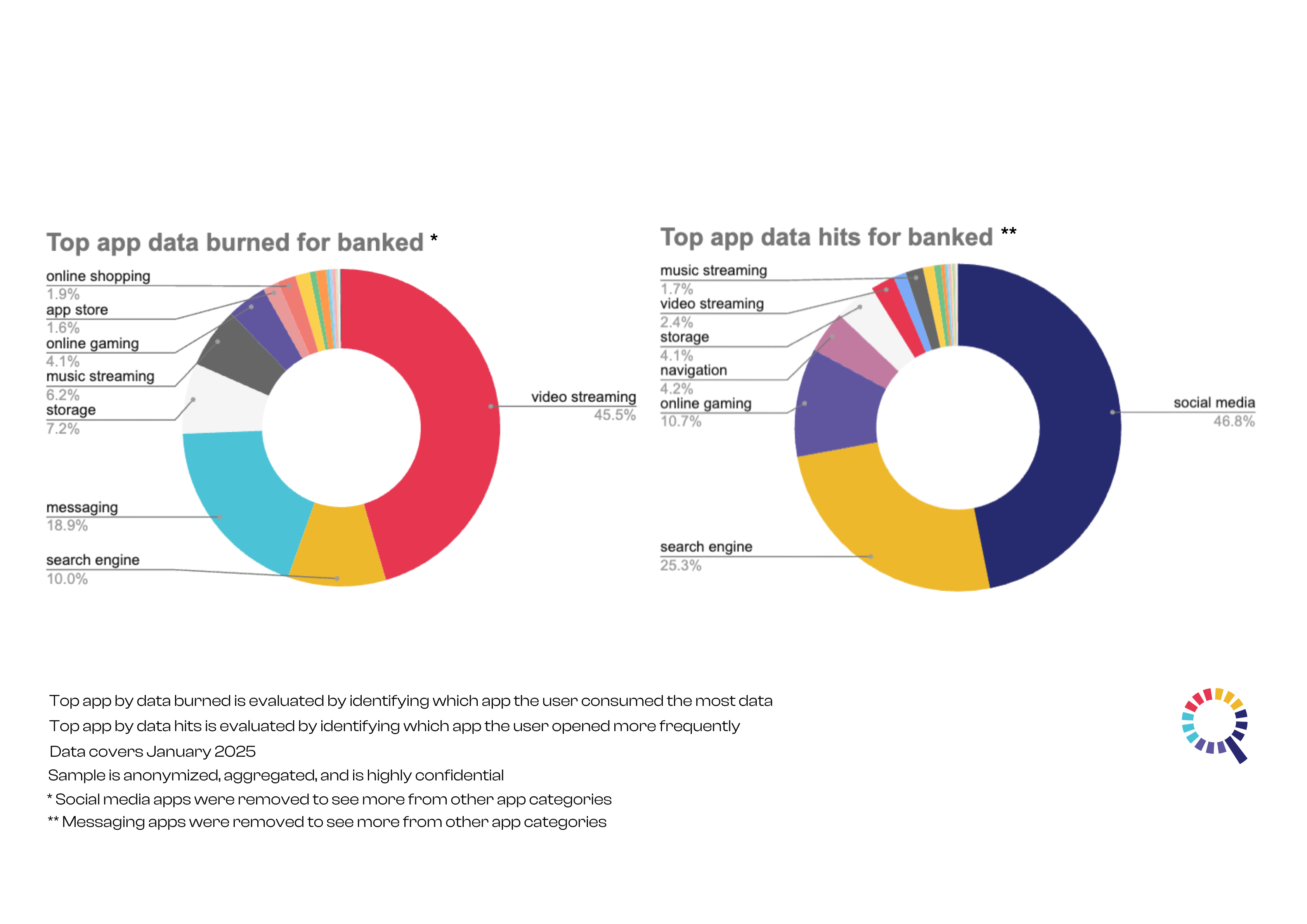

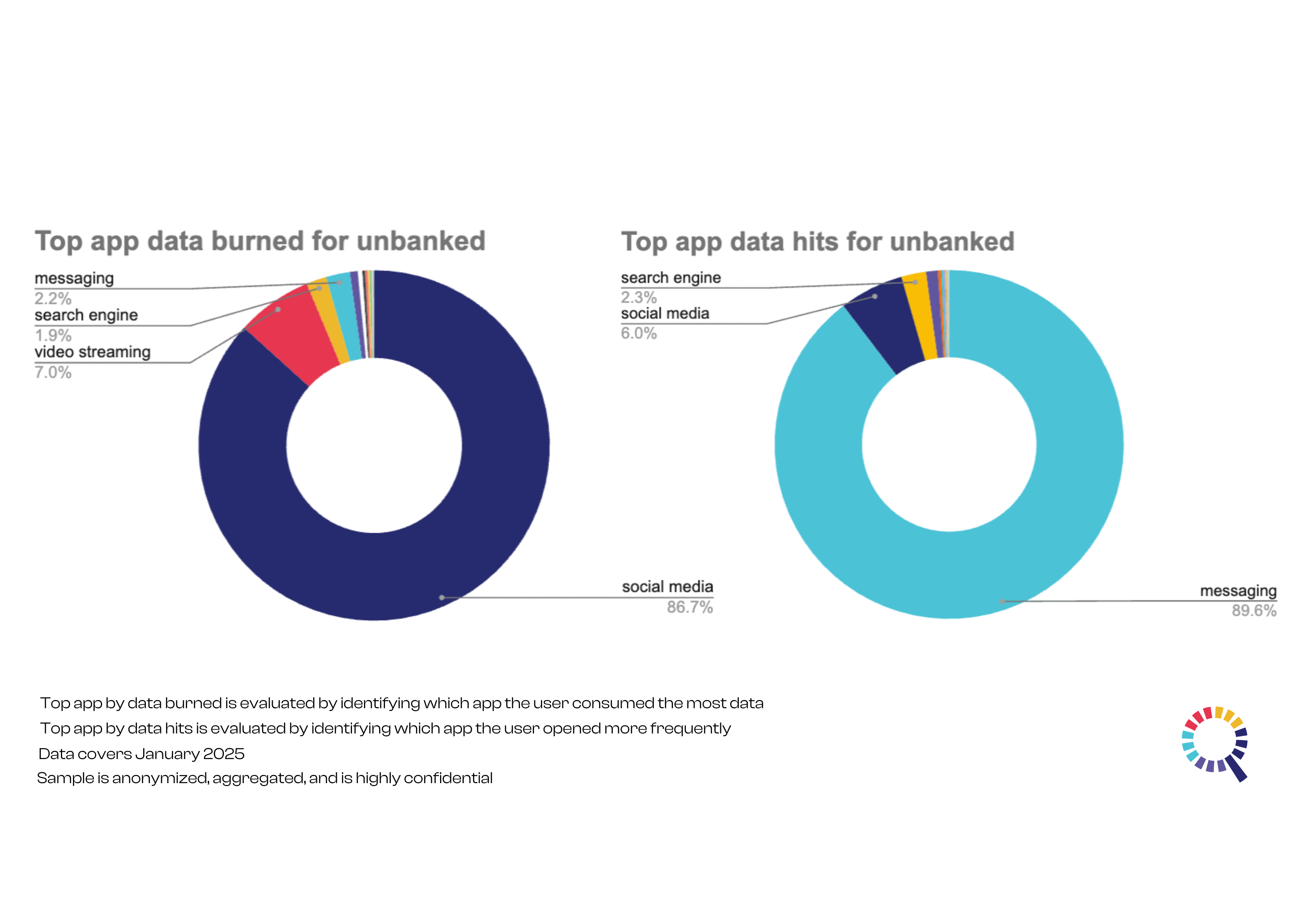

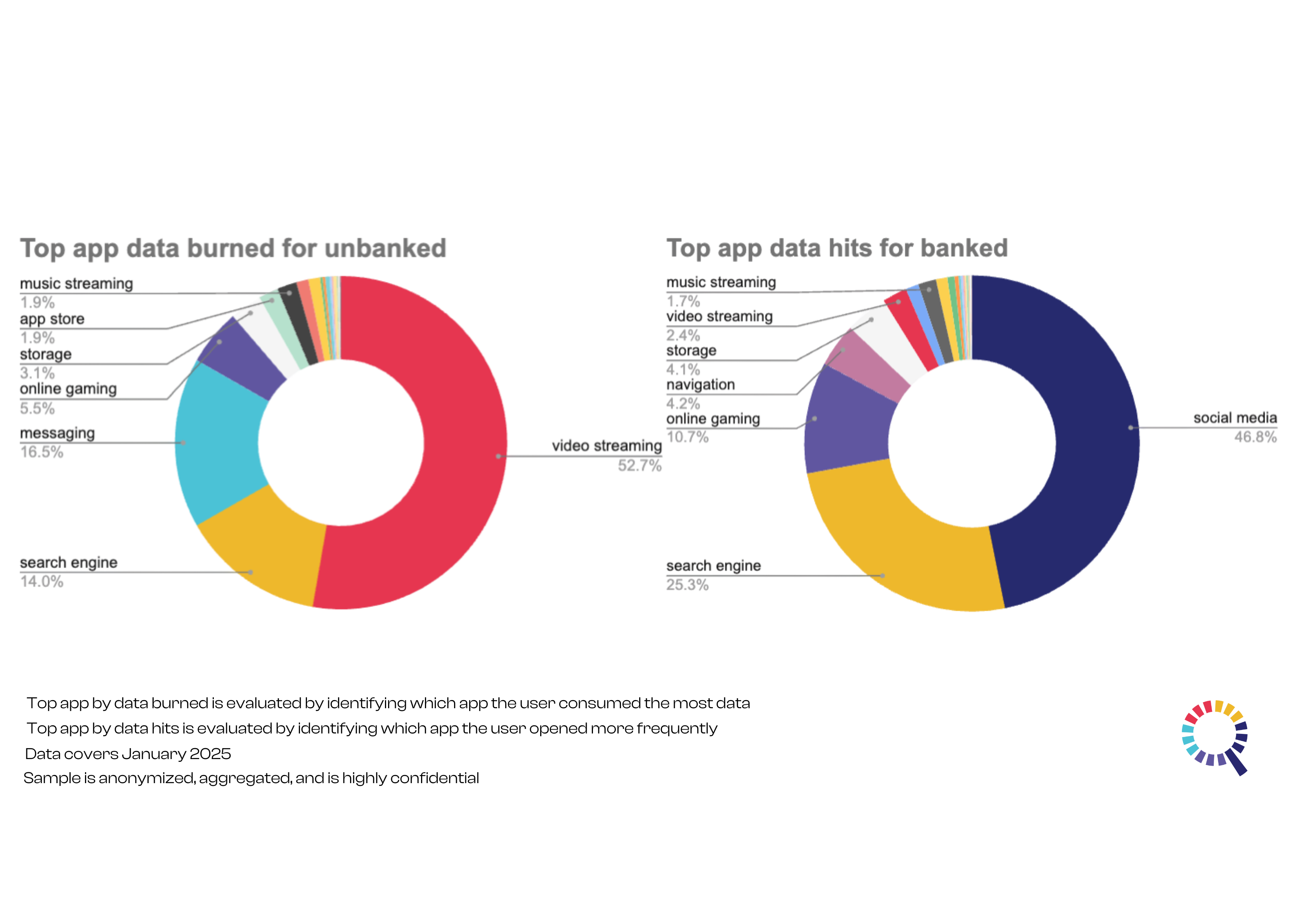

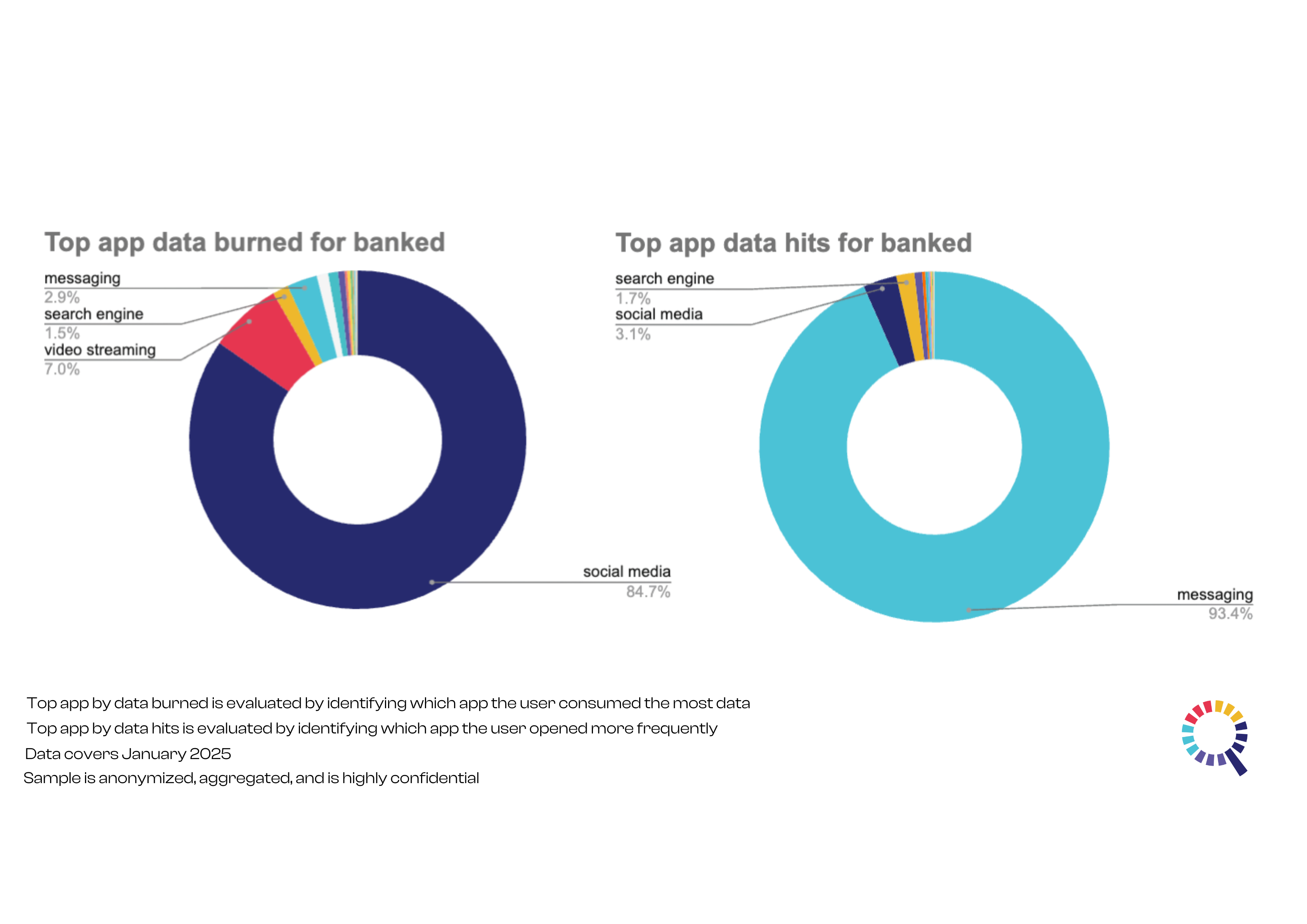

How do we tap the unbanked? We can use top apps used by each profile. For privacy purposes, we chose to categorize these apps into social media, messaging, video streaming etc. For the unbanked, social media is the highest area of data spend at 87%. Messaging is the top app by frequency of usage at 90%. Search engine is 3rd for both data spend and frequency. A campaign to tap the unbanked market should prioritize these ads spaces for better visibility. Note that we know the actual apps behind these categories, you can contact us to inquire about the applications.

Aside from social media and messaging apps, video streaming and search engine are mostly the top apps for both data used and frequency of use. Banks can allocate some ads to these digital spaces through our partnered services.

Let’s remove social media and messaging apps to see more categories.

Online gaming, and storage apps trails video streaming and search engines. These are helpful insights not just for banking industry as we can change the filter, for example to see top apps for BPO workers, or students, parents etc.

For both unbanked and banked, social media and messaging apps are the center of Filipino digital experience.

For banked individuals, navigation, storage, video conferencing, and music streaming have bigger share of their data burned and app usage. These categories are often indicator of working individuals who either commute regularly or drive a car, and uses video conferencing app. Aside from these attributes that we showed here, you may also explore further into city level top location, demographics, purchase intents etc. which is expected for someone who has formal banking account. Aside from these attributes that we showed here, you may also explore further into city level top location, demographics, purchase intents etc. But how do we know we are attracting credible profiles?

Inquiro has its own Credibility Score product which allows to filter through profiles and select credible customers. This ensures that we are tapping credible unbanked individuals.

The race to digitalization has given Filipinos plenty of ways to manage their finances. Better connectivity has trickled down to better financial inclusion. But there are still work to do. 79% of unbanked has access to internet, and 87% has a mobile phone. Inquiro can help tap the unbanked market through hyper targeted campaigns pushing content through their top apps. Contact us to start your next step towards customer acquisition. Email us at info@inquiro.ph.