Trends | Gen Z and The Credit Shift

Credit card usage in the Philippines is not just growing—it’s evolving in complexity. Recent consumer intelligence, including the 2024 TransUnion Credit Perception Index, shows Gen Z leading the charge with an 83 CPI score and now comprising nearly one-third of all new‑to‑card borrowers, up from just 15% in 2019. On the surface, this signals a potent growth segment for credit issuers and fintech players.

Despite 71% of the general population reporting that they are knowledgable about credit cards, a 2023 TransUnion executive summary noted that 69% of Filipinos still prefer cash and e-wallets, with credit usage remaining bogged by cultural stigma and unfamiliarity. 55% said they don’t want to be indebted, while 54% said it will cause them to overspend.

So what does this mean for issuers?

Opportunity: Young, digitally native Filipinos are primed for adoption—driven by mobile-first banking, BNPL integrations, and brand-driven value. The CPI’s favorable sentiment shows they want credit card access.

Risk: If standard credit products are perceived as too punitive or complicated, this demographic may reject them entirely—leaning instead toward fintech alternatives like BNPL or app-based lightweight credit.

For issuers to hit the sweet spot, acquisition campaigns must spotlight clarity, control, and empowerment, not just rewards. Think simple fee structures, buy-now-pay-later-friendly features, and straightforward onboarding. This cohort isn’t just using credit—they’re redefining what credit should feel like.

A Quick Look at the Numbers

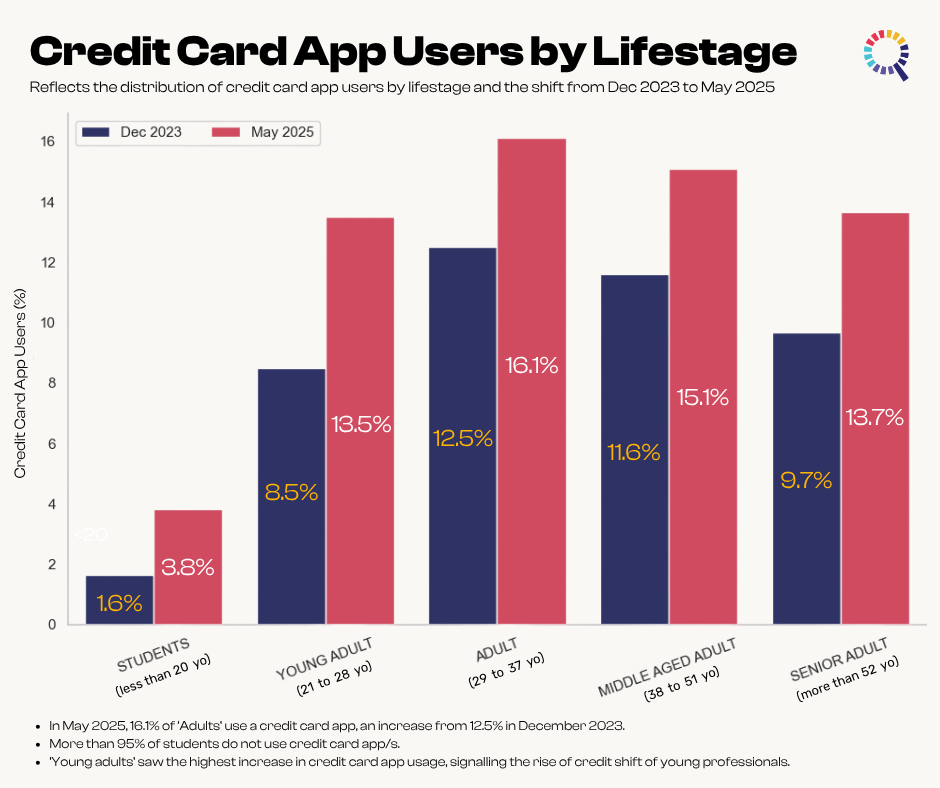

Using Marketscan data, we generated a sample The chart shows that between 2023 and 2025, credit card usage among young adults jumped from around 9% to 13.5%. Among adults and middle-aged adults, usage rates increased by approximately 3–5 percentage points. Even senior adults, traditionally the slowest adopters of new financial tools, show marked improvements. This upward trend suggests that more Filipinos across age groups are embracing credit-based financial lifestyles.

This closely aligns with TransUnion report in 2024 which found that the percentage of adults holding at least one credit card, reached over 15% of Filipino adults.

Alignment With Industry Predictions

These patterns align closely with forecasts from institutions like TransUnion Philippines and the Bangko Sentral ng Pilipinas (BSP). A 2024 report by TransUnion highlighted that 55% of Filipino consumers planned to apply for new credit or refinance existing credit in the next 12 months, with younger consumers driving demand. Similarly, BSP reported in 2023 that credit card receivables grew by over 29% year-on-year, signifying not just increased issuance but actual usage and revolving credit balances.

The trend also mirrors projections from global think tanks like McKinsey & Company and the World Bank, which emphasized Southeast Asia’s rising middle class and their growing appetite for digital financial products. As Filipino consumers become more financially literate and digitally connected, credit cards are becoming both a convenience and a tool for building credit histories.

The Digital Push and Fintech’s Role

Fintech platforms like Maya and GCash have made credit more accessible. In fact, GCash’s GCredit feature and Maya’s credit line are bridging the gap between traditional banking and underbanked consumers. These platforms offer users virtual credit lines that behave like traditional credit cards but without the same barriers to entry. As digital wallets continue to integrate financial services—such as buy-now-pay-later (BNPL), microloans, and installment options—the boundary between mobile finance and formal credit blurs, accelerating credit card familiarity and use.

These innovations particularly appeal to young adults and emerging middle-class Filipinos, who may lack access to traditional banking but are tech-savvy and economically active. Their growing confidence in using digital credit tools is likely contributing to the spike shown in the 2025 chart.

Inflation, Cost of Living, and Credit Dependency

However, the increased reliance on credit also has a macroeconomic context. Inflation in the Philippines has been relatively high in recent years, spurred by global supply chain disruptions, energy costs, and currency volatility. For example, 2022 and 2023 saw inflation rates ranging between 5–8%, impacting purchasing power significantly.

This erosion in disposable income has nudged many consumers toward short-term credit solutions to cover basic needs and manage cash flow. In that light, the growing credit card usage is not only a sign of consumer confidence—but also one of necessity. This dynamic can create opportunities and risks: while it drives credit inclusion, it also raises concerns about debt sustainability, especially among younger users.

A Changing Relationship With Debt

What’s striking in the chart is the apparent normalization of credit card ownership across lifestages. In 2023, credit card use was heavily skewed toward adults and middle-aged users. By 2025, younger users had noticeably closed the gap, signaling a shift in the cultural perception of credit. No longer viewed solely as a privilege for affluent or older consumers, credit cards are increasingly becoming a default financial tool—even among students and young professionals.

This evolution is echoed in a 2024 KPMG Philippines study, which emphasized the increasing “financial digitization” of Filipino Gen Z and Millennial consumers. The report found that younger Filipinos are more likely to engage with credit if the onboarding process is seamless, digital, and flexible. Traditional banks are responding with app-based credit card applications, instant approval, and AI-based credit scoring—removing the intimidating red tape that discouraged many first-time borrowers in the past.

Implications for the Financial Industry

The implications of this growth are significant for both incumbent banks and fintech challengers. As more consumers enter the credit economy, competition for market share intensifies. Traditional banks must adapt quickly by offering digital-first, user-centric experiences. Meanwhile, fintechs that democratize access to credit—without compromising risk controls—stand to benefit enormously.

However, with opportunity comes risk. The BSP and financial institutions must proactively monitor credit quality and household debt levels. Rising delinquency rates could emerge if users are not educated on responsible borrowing. Fortunately, there has been a parallel push in financial literacy initiatives across schools, communities, and even within apps like GCash and Maya, which now include budgeting tools and educational content.

Regionality

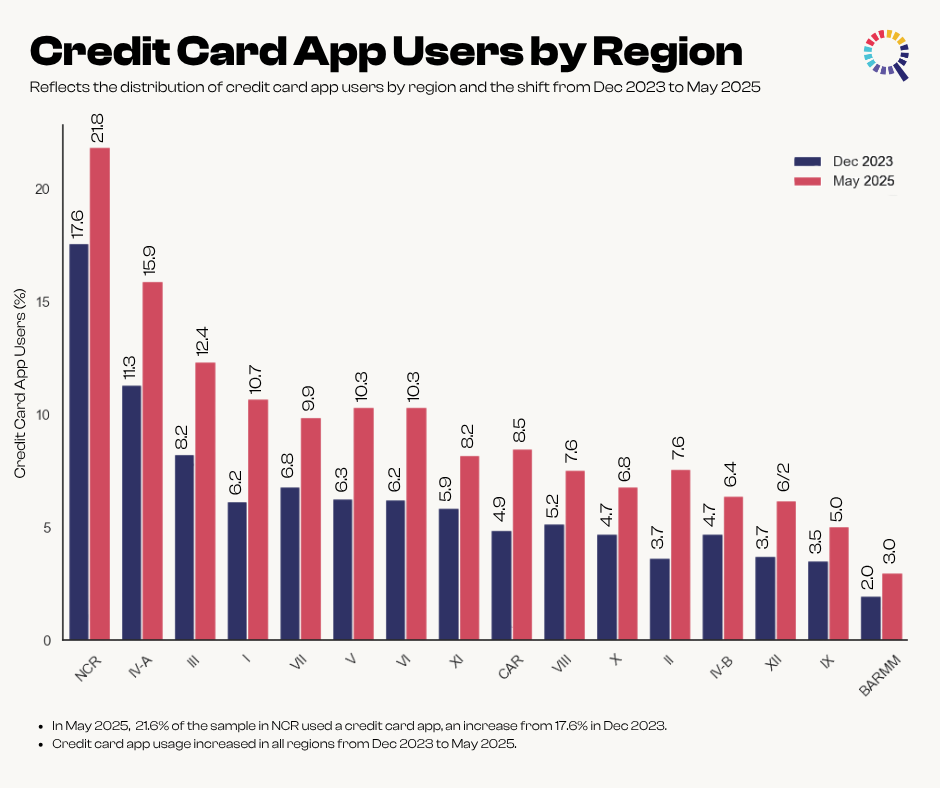

While national credit card ownership has grown, the trend reveals stark regional disparities. The National Capital Region (NCR) continues to lead by a wide margin, rising from 17.6% in 2023 to 21.9% in 2025, reflecting its highly urbanized economy and established banking infrastructure. Regions like CALABARZON (IV-A) and Central Luzon (III) also show strong gains, likely due to proximity to NCR and increasing urban migration.

In contrast, regions such as BARMM, Region IX (Zamboanga Peninsula), and Region XII (SOCCSKSARGEN) lag significantly, though they, too, saw modest gains. This mirrors ongoing challenges in banking access, income inequality, and digital infrastructure in these areas.

The visual map and bar chart comparisons highlight how economic opportunity and financial access remain concentrated in Luzon. As fintech adoption grows, however, these gaps may begin to narrow. The increasing penetration of mobile credit solutions could prove pivotal in empowering lower-income or geographically isolated regions—especially if supported by government-backed financial literacy and digital ID initiatives.

In short, regional growth in credit card usage isn’t just about spending—it’s a lens into the broader story of digital inclusion in the Philippines.

Rising credit card usage can be viewed as a barometer of consumer confidence. Filipinos are spending again—whether for travel, education, or everyday necessities—which suggests optimism about future income. This is a critical signal in a post-pandemic recovery phase, especially as the country continues to navigate external shocks like oil prices, interest rate adjustments, and geopolitical tensions.

Summary

The increase in credit card usage in the Philippines between 2023 and 2025 is more than just a financial statistic—it’s a signal of a maturing digital economy, changing attitudes toward debt, and evolving consumer behaviors. It reflects both empowerment and responsibility. As this trend continues, the focus must be on inclusive, sustainable credit practices that help Filipinos not only spend—but build, grow, and thrive in the long run.

Want to learn more about our products? Feel free to check our products and solutions. You may also check other articles related to this.